In previous blog articles, we’ve covered a broad view of cryptocurrency and profiled Bitcoin, Ethereum and several other altcoins.

👀 In this article, we’ll take a closer look at stablecoins – a class of cryptocurrencies that attempt to offer investors price stability. In our brief guide to get you on a clearer path to understanding, we’ll provide information on what they are and how they work.

❓ WHAT EXACTLY ARE STABLECOINS?

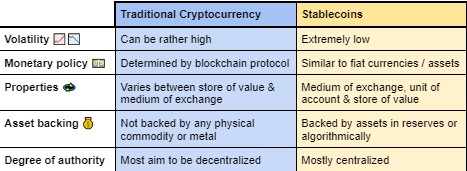

👉Stablecoins are a type of cryptocurrency that are designed to maintain a stable value by pegging to a specific asset, such as fiat currency or precious metals. They aim to provide a stable and predictable value that can be used for transactions and as a store of value.

Stablecoins use different mechanisms to maintain their value, such as collateralization, algorithms, or a combination of both. Compared to other cryptocurrencies, stablecoins have lower volatility, making them suitable for everyday transactions. As a result, stablecoins have gained popularity in the crypto ecosystem, with billions of dollars in value flowing into stablecoins like Tether (USDT) and USD Coin (USDC).

🤷♂️Why are stablecoins important?

Stablecoins offer a stable and predictable value that makes them useful as a medium of exchange, unlike volatile cryptocurrencies like Bitcoin. They can be monetized through short-term corporate and government-backed debt obligations. As a result of this, they have become enormously popular.

🤷♀️What is the purpose of stablecoins?

Stablecoins offer a less volatile alternative to popular cryptocurrencies like Bitcoin, and can be used for lending, cryptocurrency-backed loans, and payment of salaries. Blockchain networks that support smart contracts📄 allow for the development of decentralized exchanges.

The low volatility of stablecoins makes them a useful tool for investors seeking to reduce risk, and they are likely to play a critical role in the development of decentralized finance (DeFi)).

📊 DIFFERENT TYPES OF STABLECOINS

There are several types of stablecoins, including:

- Fiat-collateralized stablecoins (centralized): Backed by fiat currency. For every stablecoin in circulation, there is an equivalent amount of fiat currency held in reserve. Tether (USDT) is a popular fiat-collateralized stablecoin that is pegged to the US dollar.

- Crypto-collateralized stablecoins (decentralized): Backed by other cryptocurrencies. For every stablecoin in circulation, there is an equivalent amount of another cryptocurrency held in reserve. MakerDAO’s Dai (DAI) is a popular crypto-collateralized stablecoin that is pegged to the US dollar.

- Commodity-backed stablecoins: Pegged to the value of a physical commodity such as gold, silver, or oil, providing a more stable store of value than traditional crypto. The stablecoin issuer holds a reserve of the physical commodity to back up the stablecoin's value. Often audited by a third-party to ensure transparency and legitimacy.

- Algorithmic / hybrid stablecoins (decentralized): Not backed by any physical asset but instead use complex algorithms to maintain a stable value, backed by smart contract collateral.

- Non-collateralized / seigniorage-style stablecoins: Also rely on complex algorithms to maintain their peg, but without any reserves in smart contracts. They adjust their supply by inflating or destroying their circulating supply in response to supply and demand, generating more tokens or buying them back with seigniorage (profits generated).

*Algorithmic stablecoin issuers can become exposed to market runs. The price of TerraUSD (UST) plunged more than 60% on May 11, 2022, vaporizing its peg to the U.S. dollar, as the price of the related Luna token used to peg Terra slumped more than 80% overnight.

🏆 TOP STABLECOINS

Tether (USDT) – the second most traded cryptocurrency after Bitcoin. This popular fiat-collateralized.stablecoin was launched in 2014 in Hong Kong. It has a current market capitalization of over USD$82 billion.

USD Coin (USDC) – another popular fiat-backed stablecoin launched in 2018 by Circle and Coinbase. Current market capitalization: USD$30 billion.

Binance USD (BUSD) – a fiat-backed stablecoin created by Binance exchange and Paxos Trust Company for trading and transactions inside and outside Binance. Current market capitalization: USD$5.9 billion.

Other notable stablecoins include Dai (DAI), True USD (TUSD), and Euro-pegged stablecoins STASIS EURO (EURS) and Euro Coin (EUROC).

✔️ADVANTAGES & ❌DISADVANTAGES OF STABLECOINS

✔️ Borderless payments🌎

✔️ Low fees💰

✔️ Faster transactions💫

✔️ Transparency👀

✔️ No volatility📊

❌ Centralization🔒

❌ Dependence on traditional financial markets💸

❌ Unregulated🤠

🔮 STABLECOINS: LOOKING AHEAD

Stablecoins act as a bridge between fiat and crypto, providing a storage place for traders and investors to avoid crypto market volatility. But relying too much on stablecoins or a leading stablecoin crash could harm the crypto space. Consequently, regulatory compliance that supports decentralization and censorship resistance is necessary.

The idea of a digital dollar, a shadow currency that takes fiat onto the blockchain without risking its value, is gaining appeal with support from respected players.

👉 EARNING TETHER (USDT) & OTHER CRYPTO WITH BLOOM

🤑 By simply accessing the Bloom mini-app within the Binance app’s Marketplace tab and linking your Visa card, you can earn Tether (USDT) with every spend.

📲.The Bloom shopper rewards app allows you to earn other crypto (like Bitcoin, Ethereum and a range of other altcoins) with every purchase made on your Visa card 💳.

🦉 All you need to do is download the Bloom app, register an account, link your Visa card and shop anywhere using your credit or debit card.

💰 With every purchase, you will earn Bloom Coins by simply using your Visa card💳. The more you use your card, the more Bloom Coins you will earn.

🎁 Bloom Coins can be redeemed for in-app rewards and converted into crypto.

🆓 Converting crypto on Bloom is free of charge and has no gas fees!

💎 Earn exclusive 3x Bloom Coin rewards with a Premium Membership.

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. Bloom does not recommend that any cryptocurrency or NFTs should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.